The Buzz on Feie Calculator

The Buzz on Feie Calculator

Table of ContentsRumored Buzz on Feie CalculatorThe Single Strategy To Use For Feie CalculatorAll About Feie CalculatorThe Definitive Guide for Feie CalculatorThe Definitive Guide for Feie Calculator

United States deportees aren't limited just to expat-specific tax obligation breaks. Frequently, they can claim most of the very same tax credits and reductions as they would in the US, including the Kid Tax Debt (CTC) and the Lifetime Discovering Debt (LLC). It's feasible for the FEIE to lower your AGI so a lot that you don't receive specific tax debts, though, so you'll need to double-check your qualification.

The tax obligation code says that if you're an U.S. person or a resident alien of the United States and you live abroad, the internal revenue service tax obligations your globally revenue. You make it, they tire it no matter where you make it. You do obtain a wonderful exemption for tax obligation year 2024 - Bona Fide Residency Test for FEIE.

For 2024, the maximum exclusion has actually been enhanced to $126,500. There is also an amount of qualified real estate costs eligible for exemption. Normally, the optimum amount of housing costs is restricted to $37,950 for 2024. For such calculation, you require to determine your base housing quantity (line 32 of Kind 2555 (https://yamap.com/users/4718731)) which is $55.30 per day ($20,240 each year) for 2024, increased by the number of days in your qualifying duration that drop within your tax year.

More About Feie Calculator

You'll need to figure the exclusion initially, since it's restricted to your foreign gained revenue minus any type of international housing exclusion you assert. To get approved for the foreign gained earnings exclusion, the international housing exclusion or the foreign housing reduction, your tax home have to remain in a foreign nation, and you need to be just one of the following: A bona fide local of a foreign nation for a continuous period that includes a whole tax year (Authentic Resident Examination).

If you declare to the foreign government that you are not a resident, the test is not pleased. Qualification for the exemption can likewise be influenced by some tax obligation treaties.

For united state residents living abroad or gaining revenue from international resources, inquiries commonly develop on how the U.S. tax obligation system puts on them and just how they can make sure compliance while minimizing tax obligation responsibility. From comprehending what international earnings is to navigating numerous tax obligation types and reductions, it is essential for accounting professionals to understand the ins and outs of united state

Dive to Foreign revenue is specified as any kind of revenue gained from resources beyond the United States. It includes a large array of financial tasks, including but not limited to: Incomes and salaries gained while working abroad Benefits, allocations, and benefits offered by international employers Self-employment earnings derived from foreign businesses Rate of interest gained from foreign checking account or bonds Rewards from international companies Capital gains from the sale of international assets, such as genuine estate or stocks Earnings from renting foreign properties Income created by foreign organizations or partnerships in which you have an interest Any type of various other earnings made from foreign sources, such as aristocracies, alimony, or gambling payouts International gained revenue is defined as income gained via labor or services while living and functioning in a foreign nation.

It's essential to differentiate foreign gained earnings from various other sorts of foreign earnings, as the Foreign Earned Income Exemption (FEIE), a useful U.S. tax obligation benefit, specifically applies to this category. Investment revenue, rental earnings, and passive income from foreign resources do not get the FEIE - FEIE calculator. These sorts of income may be subject to various tax therapy

resident alien that is a person or nationwide of a country with which the USA has a revenue tax treaty effectively and who is a bona fide local of a foreign country or nations for a nonstop period that includes an entire tax obligation year, or A united state citizen or an U.S.

Feie Calculator Can Be Fun For Anyone

Foreign earned income. You need to have made revenue from work or self-employment in a foreign country. Passive revenue, such as interest, dividends, and rental income, does not get approved for the FEIE. Tax home. You should have a tax home in an international country. Your tax obligation home is normally the place where you perform your normal organization tasks and keep your main economic passions.

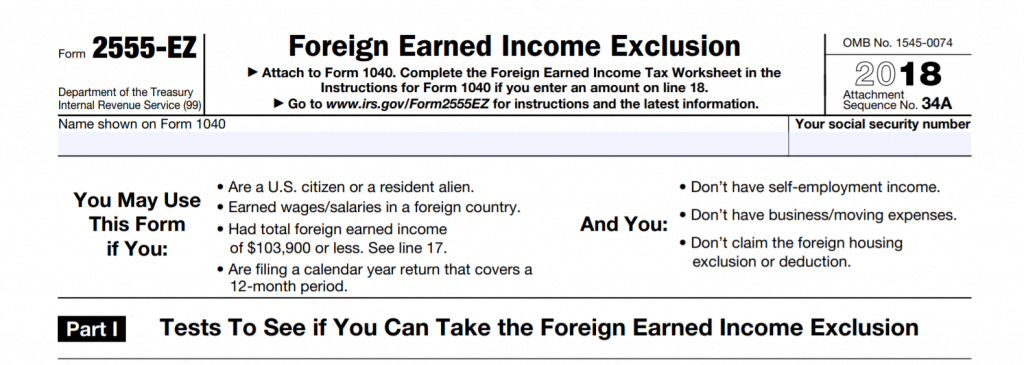

This credit history can offset your U.S. tax obligation on foreign income that is not eligible for the FEIE, such as financial investment revenue or passive earnings. If you do, you'll after that file added tax kinds (Form 2555 for the FEIE and Type 1116 for the FTC) and affix them to Type 1040.

The 10-Minute Rule for Feie Calculator

The Foreign Earned Income Exclusion (FEIE) allows eligible individuals to exclude a part of their foreign made earnings from united state taxation. This exclusion can considerably minimize or eliminate the U.S. tax obligation on foreign income. The details quantity of foreign income that is tax-free in the United state under the FEIE can change yearly due to rising cost of living adjustments.